Notes on Inflation

This post is a largely a collection of quotes and some personal notes I took after reading Michael Burry’s (now deleted) tweets on “the impending inflation crisis” about to hit the world.

Introductory Economics for Inflation

Price and value

The price of a product represents the real value of the product, and this price is the fair value, according to the Efficient market hypothesis. The price of any product is set by supply/demand as well as other economic forces compelling the supply and demand. You cannot sell a potato for $1 million and expect to get any buyers. Thus, in a “free” market, you are free to choose the price of a potato, but your “freedom” is governed by the real world economics of the process of farming a potato.

The other factor determining price is “liquidity preference” or “velocity”. If I don’t want to spend my money today, no matter what price you set, no trade will take place. This in-turn inflates the price because I have limited the supply of currency. Velocity is key as an acute rise in velocity is usually the point of no return for a inflationary currency. Using these two factors we can define a price level:

Price level = (Money quantity X Money velocity) / (Supply of all real values)

The price equation in the simple form only operates in equilibrium conditions. In disequilibrium, such as immediately after a monetary inflation has occurred, the formula can only state what prices will be when a new equilibrium is restored, and not what actual prices are at any time in between.

An increase of 10 percent in the money supply is not inflationary if there is also a 10 percent increase in the supply of real values, or if there is a 10 percent decrease in velocity.

Monetary inflation is the cause of price inflation, but the response of effect to cause is far from instantaneous. If there is a sudden monetary inflation of 10 percent, experience tells us that prices do not immediately rise by 10 percent, nor in fact may they rise at all for a considerable time. The price equation as we have stated it does not appear to allow for this, and if it can be in error on this point perhaps it is wrong altogether.

This analysis corresponds with the evidence of every important inflation of history, including the German inflation and the American inflation. Money supply increases, money velocity falls behind, and prices remain steady. Later money velocity recovers, prices begin to rise, and equilibrium eventually returns at the level fixed by the original money supply inflation.

Money and it’s functions

Money has 2 functions: a token of exchange and a store of value. The only truly legitimate function of money is the first, the exchange function. Without the need for a medium of exchange, there would be no need for money. As stores of value, other kinds of property are just as good or better. Money has no utility except in exchange.

In the beginning, money holders were temporarily willing to hold their excess money, slowing down velocity and leaving prices unchanged. Later, in the mid-course of an inflationary cycle, money quantity and velocity both increase, thereby compounding the inflationary effects of one another. After overcoming its initial inertia, velocity does not merely return to its former rate but may accelerate past it. People naturally wish to hold money less and to spend it faster when they see its value falling. At the end of an inflationary cycle, velocity rises faster than money quantity, though only for a limited time after the quantity inflation stops.

The German Inflation

In 1919, all countries faced heavy inflation due to wartime spending, however every other country then went into a recession in 1920 as they stopped deficit financing. However Germany continued printing money through 1920 and inflate its currency. Germany’s remarkable prosperity during this period was a facade, as although prices remained stable throughout 1920-21, it’s money supply had doubled. “The catastrophe of 1923 was begotten not in 1923 or at any time after the inflation began to mount, but in the relatively good times of 1920 and 1921.”

Similarities to our current situation in 2020

It all began with printing of new currency:

The beginning was in the summer of 1914, a day or two before World War I opened, when Germany abandoned its gold, standard and began to spend more than it had, run up debt, and expand its money supply. The end came on November 15, 1923, the day Germany shut off its money pump and balanced its budget.

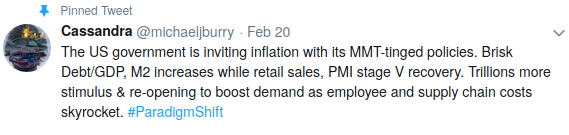

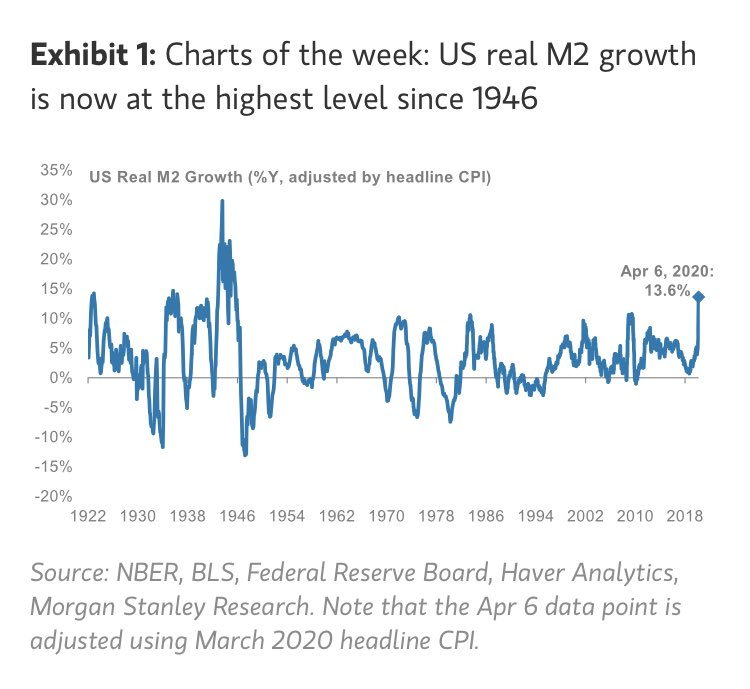

And it’s 2020 equivalent:

Although this is not enough evidence without data on velocity and real-value.

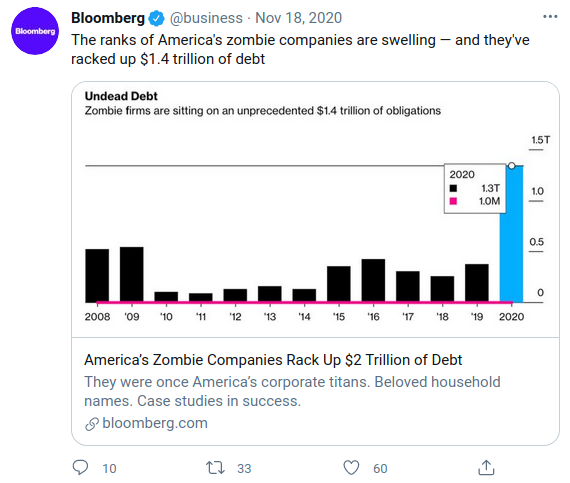

Zombie businesses started to sprout up:

Almost any kind of business could make money. Business failures and bankruptcies became few. The boom suspended the normal processes of natural selection by which the nonessential and ineffective otherwise would have been culled out. Practically all of this vanished after the inflation blew itself out.

The rise of speculation seems to be a defining characteristic.

Speculation alone, while adding nothing to Germany’s wealth, became one of its largest activities. The fever to join in turning a quick mark infected nearly all classes, and the effort expended in simply buying and selling the paper titles to wealth was enormous. Everyone from the elevator operator up was playing the market. The volumes of turnover in securities on the Berlin Bourse became so high that the financial industry could not keep up with the paperwork, even with greatly swollen staffs of back-office employees, and the Bourse was obliged to close several days a week to work off the backlog.

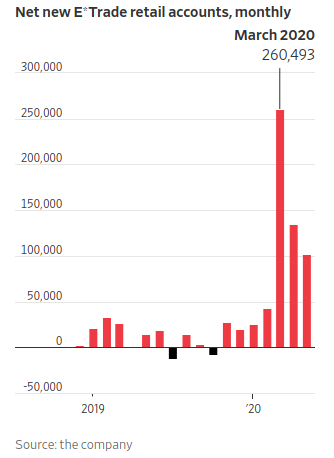

2020 is no different:

Individuals now account for a fifth of all stock-market activity and a quarter during the busiest sessions.

Downfall

Beginning in July 1922, prices rose tenfold in four months, two hundredfold in eleven months. Near the end in 1923, prices were at least quadrupling each week. The worker had to compute his pay in the trillions, carry it in bales, and spent it instantly lest he lose it. The seas of marks which had been stored up by Germans and especially by trusting foreigners flooded forth and fought to buy into other investments, foreign currencies, tangible goods, almost anything but marks.

All the marks that existed in the world in the summer of 1922 (190 billion of them) were not worth enough, by November of 1923, to buy a single newspaper or a tram ticket. Germany’s inflation cycle ran not for a year but for nine years, representing eight years of gestation and only one year of collapse.

Farmers, who were comfortable enough, would not sell their food to the townsmen for their worthless money. Starvation and abject poverty reigned. The middle class virtually disappeared as professors, doctors, lawyers, scientists and artists pawned their earthly goods and turned to field or factory to try to earn a little food.

Inflation was finally halted due to the introduction of a new currency, pegged 1 trillion to 1 to the old currency.

The grand-daddy of all credit squeezes ensued from Dr. Schacht’s order of April 7, 1924, which stopped all credit from the Reichsbank. New inflation, which had begun to stir again, was then abruptly and finally stopped. The entrenched interests in Germany, especially the industrialists like Stinnes, characteristically fought Schacht every inch of the way, although a few later acknowledged the tightness of his course.

The people who lost the most were the middle class and the people who saved for a rainy day. All pensions and savings were instantly worth nothing. People who lived paycheck to paycheck, without any savings experienced no loss in quality of life if they managed to retain a job

Despite the obliteration of the wealth of millions of individual Germans, the inflation was merely a transfer of their wealth, like any tax, and not in any sense a destruction of wealth. For every German’s total loss, there was an equivalent gain to some other German debtor or to Germany as a whole, through the discharge of their debts.

Some other characteristics of the German inflation

People bought marks in large quantities due to a belief in the fact that a major country like Germany cannot fail, even though they knew money was being printed like crazy (Just like the USD now)

Until 1922 and the very brink of the collapse, Germans and especially foreign investors were absorbing marks in huge quantities. Only the international reputation of the Reichsmark, the faith that an economic giant like Germany could not fail, made this possible.

The prices remained stable for a time because people were hoarding marks and the money had no velocity

The storage factor caused by the investor’s willingness to save marks kept the marks from being dumped immediately into the markets, and thereby for a long while held prices in check.

The government officials knew about the impeding inflation but decided to print money anyways

Helfferich knew perfectly well the relationship between money creation and price inflation; but, he said in substance, under the circumstances in Germany nothing could be done about it. Germany had to create money because Germany needed money. Helfferich’s abysmal failure in the German inflation represented more than anything else a tragedy of pure intellect, for he was constantly resorting to the most finely-reasoned theorization for answers that ignored simple observation of the facts. Helfferich illustrates the dangers of allowing pure intellect to rule practical government policy

The forex rate was a better indicator of inflation than internal prices of goods

(The German mark) almost always had a considerably lower foreign exchange value than its internal purchasing power within Germany. This merely meant that the foreign exchange rate was a much quicker and more sensitive indicator of the inflation of the mark than internal prices were. German exports increased and imports decreased continuously throughout the inflation. Other nations fitfully took steps to defend themselves from being flooded with cheap German exports. The effect of these unnaturally cheap exports on the German nation as a whole was simply to give away to other nations, without adequate return, a considerable portion of the fruits of the nation’s effort.

How to protect yourself against inflation

You number one goal during an inflationary crisis is the protection of your wealth. Making any real profits in a dying inflation is practically out of the question. With clairvoyance or hindsight it could be done,and there were probably a few Germans who did do it, but anyone who dares try to play a decaying inflation for anything but defense against loss is playing a perilously greedy game.

The effects of inflation on investments

As Warren Buffet points out:

Only gains in purchasing power represent real earnings on investment. High rates of inflation act as a tax on investment and this is a tax which renders most investments useless. Most companies cannot go past this “hurdle rate” needed for investment in them to be of any value. Income tax is limited by reported income, however inflation tax is not. This means that income tax alone cannot make positive corporate return to a negative investor return. For capital to be truly indexed, return on equity must rise, i.e., business earnings consistently must increase in proportion to the increase in the price level without any need for the business to add to capital - including working capital - employed. (Increased earnings produced by increased investment don’t count.) Only a few businesses come close to exhibiting this ability.

And Berkshire Hathaway isn’t one of them.

Forex

Foreign money, especially the American dollar as irony would have it, had been the safest refuge a German could seek in 1921 and 1922.

Gold, real estate, farmland, bitcoin and other “store’s of value”

Most of the value of gold lay in that people expected it to have value, and that value could last only as long as the expectation. That expectation had endured over thousands of years, and it might endure forever. Or it might not. It was anybody’s gamble.

The problem with assets like gold, real estate, farmland is that they are overvalued, and this overvaluation exists even before the inflation begins. So after the inflation, their price may drop to below pre-inflation levels. However, since they retain their “real-value”, they are still a decent choice to store wealth.

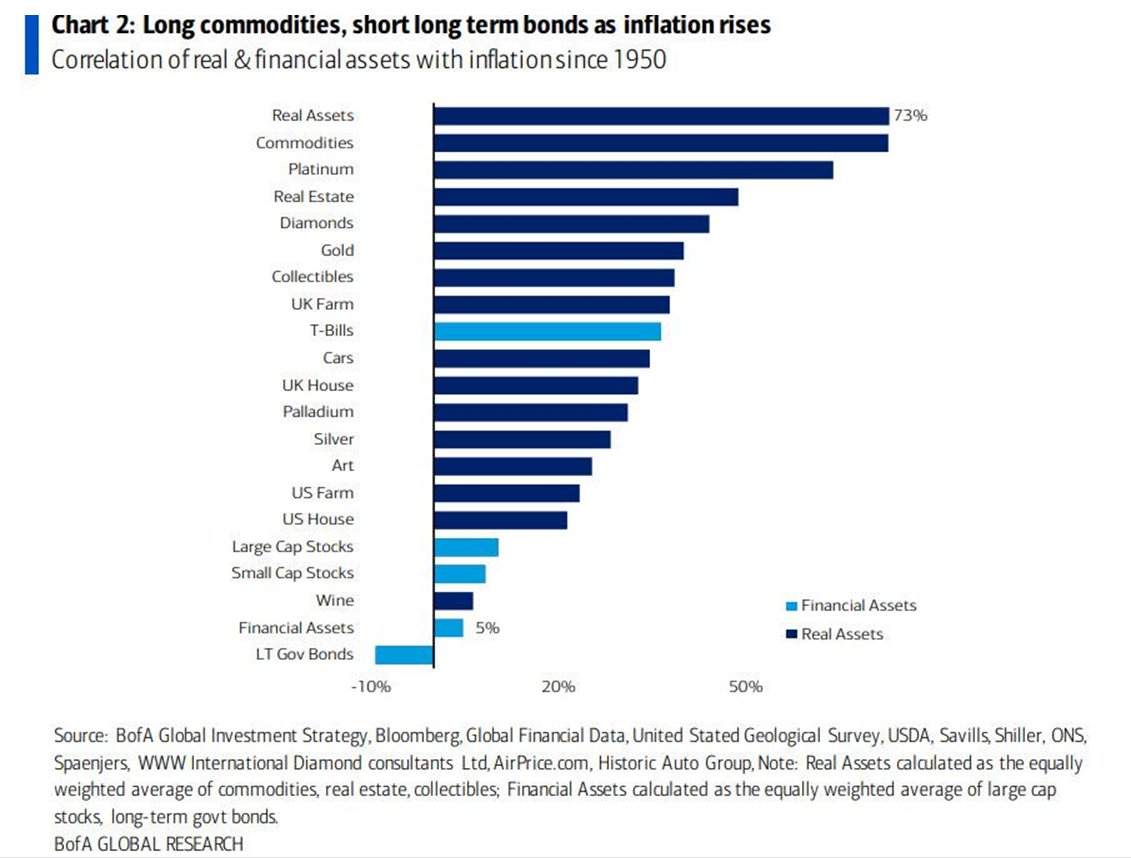

Historical asset performance during a recession.

“Useful goods”

If all other kinds of investment will have difficulty holding their value in inflation, it must be because the prices of goods will rise faster than the prices of investments. It follows that goods would be a better investment than investments are. Theoretically, this is true. Any German could have made himself quite rich by acquiring a large store of under priced food or other goods in 1920 and then trading this store later in the inflation for houses, stock of solid industries, or whatever other real assets he might fancy at ridiculously low relative prices.

However this is difficult to invest in such goods due to the storage, carrying and distribution costs involved. Farmers in particular were the classic case of invulnerability to inflation, because they always had food, their farms were constant values, and the many who had mortgages on their farms were forgiven their debts outright.

Stock market

The key here is to think about what businesses represent real value and will continue to represent real value after the inflation passes, and invest in those businesses. There will be many other businesses which will rise to astronomical levels simply due to reflexivity and hype, but they must be avoided as they do not represent any underlying real value.

Individual stocks that became the darlings of capital gain cultists rose to prices much higher than the market, and much higher than their real value in conditions of stability could justify. They could not help but lose value back to that level. On the other hand, many of the most useful and basic kinds of business had been relatively disfavored by the inflation, their stocks had suffered accordingly, and in the purging of the inflation both their business and their stocks’ values could be expected to improve at least as much as the prices of goods.

Successful self-defense in the stock market was a matter of projecting oneself mentally into the post-inflationary world for a look around, seeing which businesses would thrive as well as ever and which would not, and then returning to inflation’s midst to buy the stocks of companies which would be thriving later and were doing at least passably well.

Investors were extremely slow to grasp that stocks were poles apart from fixed obligations like bonds, quite wrongly thinking that if bonds were worthless stocks must be too. Nearer the end in 1923, relative prices of stocks skyrocketed again as investors returned to them for their underlying real value. Stocks in general were no very effective hedge against inflation at any given moment while inflation continued; but when it was all over, stocks of sound businesses turned out to have kept all but their peak boom values notably well. Stocks of inflation-born businesses, of course, were as worthless as bonds were.

Debt

To win in an inflationary environment, borrow money before the bubble bursts

The largest gainer by far, because it was the largest debtor, was the Reich government. The inflation relieved it of its entire crushing debt which represented the cost of the war, reconstruction, reparations, and its deficit financed boom. Others who were debtors emerged like the government with large winnings. Until the last moment of the inflation borrowers continued to make huge profits simply by borrowing money and buying assets, because lenders never stopped underestimating the inflation.

A majority of the quotes in this post are from the book Dying of Money by Jens Parsson.