The Solana India Fellowship Saga

This post is a part of a series of posts documenting my experience as a fellow in the Solana India Fellowship. You can find other posts in this series here.

Week[7]

We are done with all the exercises and quests for the fellowship! We are now in the 2nd phase, where all the fellows have to build out a complete project on Solana. Since week 2, I have been brainstorming and building out Aureus - a buy now, pay later style product on top of Solana pay. I have finalized a lot of details and also iterated on the code for a bit, here is my “one pager” for the project:

Aureus Pay

Auerus allows you to get Instant loans while using Solana Pay.

Overview

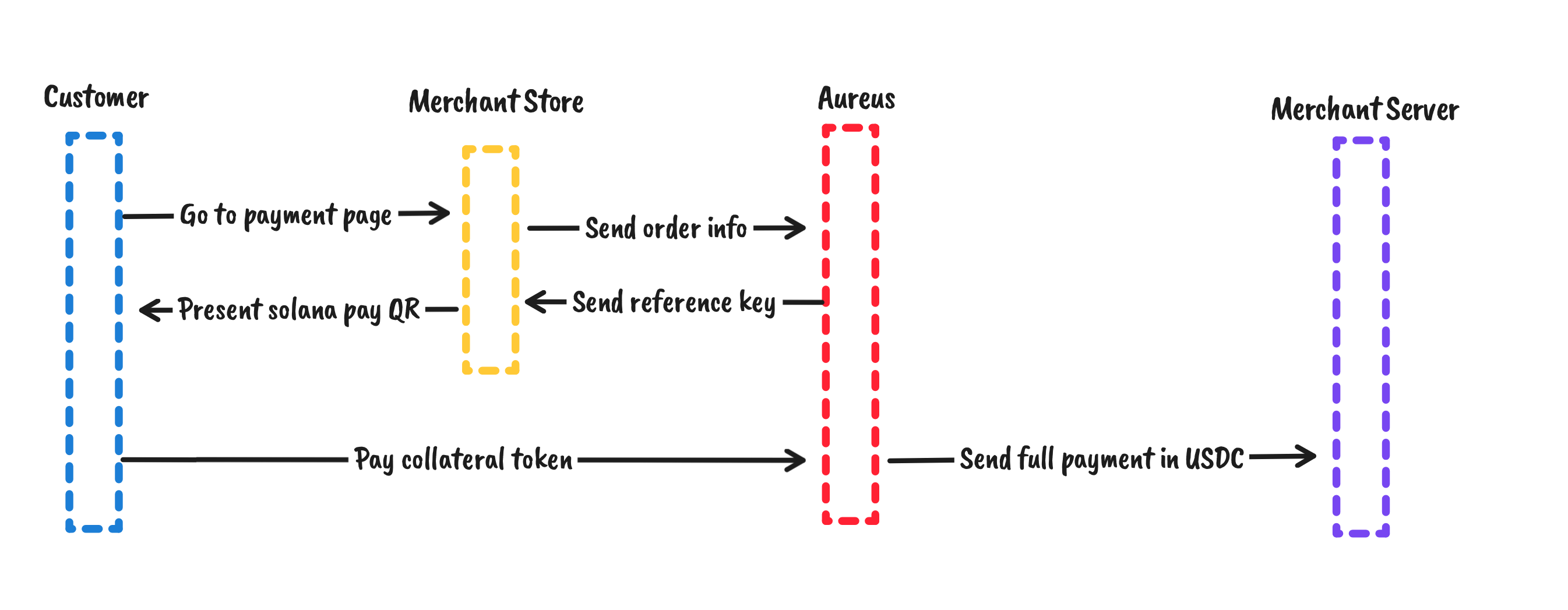

Solana pay is a URL specification and does not have any on-chain footprint. If a merchant on Solana pay only accepts USDC, a customer with SOL in his wallet cannot make a payment even if he has enough funds. Aureus aims to fix this buy allowing users to lock up SOL/SPL tokens as collateral while the merchant gets instant payments in USDC. The user can then pay back his loan incrementally.

Features

- Instant payment to merchant in USDC/SOL/SPL tokens, while the on-chain program takes on any price/volatility risk.

- The user gets to choose a fixed payment term (from 4 to 16 weeks), with variable interest rate.

- Collateral is freed incrementally as the user repays his obligation.

- If the payment term expires, any remaining locked collateral is liquidated.

Operating model

- Liquidity will be provided by using one of the already available lending protocols on Solana. (Solend, Jet, Oxygen, etc)

- Aureus will automatically select the cheapest protocol to borrow from, but advanced users will also have the option to choose a protocol they want.

- Aureus itself earns revenue by charging a flat rate (typically less 0.2%) on top of the base borrowing rate.

The purchase flow

Future

- Given enough users, Aureus can create its own borrowing and lending platform, with anyone being able to contribute liquidity.

- Add support for more complex products such as NFTs as collateral.